Introduction

Think you’re fully covered with a comprehensive car insurance UK policy?

You might want to look again.

Even though the name suggests it all, comprehensive car insurance doesn’t protect you from every mishap — and the gaps might shock you.

In this guide, we’ll reveal what “comprehensive” really means, and more importantly, what it doesn’t.

Why So Many Drivers Get It Wrong

Comprehensive car insurance UK sounds complete — but that’s exactly where the confusion begins.

It’s not your fault.

Every year, thousands of UK drivers hit the road with the belief that “comprehensive” equals “total protection.”

But here’s the kicker:

They only realise the truth when it’s too late.

Take this common example:

You’re driving home from a wedding.

It’s pouring down.

You hydroplane into a barrier.

You’re safe — thankfully.

The car?

Not so much.

You assume your insurance covers the damage.

But wait.

You didn’t pay for windscreen cover.

Now you’re stuck with a shattered view and a hefty bill.

Still think comprehensive covers everything?

Think again.

According to industry data, a significant number of drivers never check their exclusions list.

Worse still, they don’t realise how many benefits are optional.

If you haven’t looked at your policy in a while, you’re not alone.

But that could be costing you money — and protection.

Curious how your policy compares to others?

Explore your car insurance options here.

What Comprehensive Car Insurance UK Does Cover

Let’s start with the good news.

Comprehensive insurance absolutely provides the broadest level of protection available.

Here’s what’s typically included:

- Damage to your car in an accident — even if it’s your fault

- Third-party damage (vehicles, property, people)

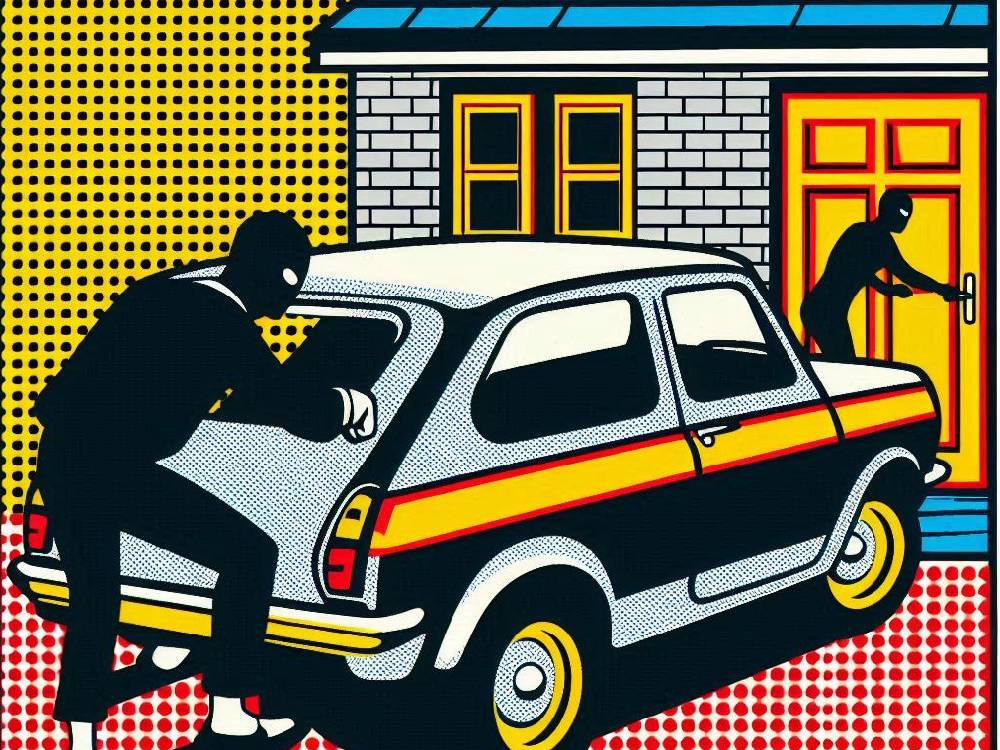

- Theft or attempted theft

- Fire damage

- Accidental damage (within certain limits)

It sounds generous — and in many ways, it is.

Especially compared to third-party-only policies, which offer just enough to legally get on the road.

So if you’re thinking of upgrading from third party?

But don’t relax just yet.

Because there are cracks in that coverage — and they’re bigger than you’d think.

But Here’s What Comprehensive Car Insurance UK Doesn’t Cover

This is where things get murky.

Despite the name, comprehensive policies don’t automatically include cover for:

- Vandalism (like keyed paint or smashed mirrors)

- Windscreen chips or cracks

- Driving someone else’s car (unless explicitly stated)

- Courtesy cars if yours is written off

- Transport home after an accident

- Breakdown recovery

- Child seat replacement, even after a collision

Sound surprising?

You’re not the only one.

You should check your policy documents to understand what is and isn’t covered…

Here’s a shocker:

Even if your car is vandalised while parked outside your own home, many comprehensive policies won’t cover it unless you’ve paid extra.

Same goes for windscreen damage.

And driving a friend’s car?

Unless your certificate specifically says DOC (Driving Other Cars), you could be uninsured entirely.

That’s a nightmare waiting to happen.

Think of your insurance like a phone plan.

Yes, you’ve got coverage.

But without extras?

You might get stung by every cracked screen or missed connection.

Wondering if breakdowns are included?

Here’s why breakdown cover is worth a second look.

Optional Extras That Can Fill The Gaps

Now, for the smart move.

Many of the things missing from a standard comprehensive policy can be added on — for less than you might expect.

Some examples?

- Windscreen protection

- Legal expenses cover

- Replacement keys

- Personal accident cover

- Courtesy car provision

- Breakdown assistance

These are often listed as optional add-ons at the quote stage.

And here’s the twist:

They’re usually affordable — especially compared to the cost of repairs or legal disputes without them.

Don’t make the mistake of opting for the cheapest quote without checking what’s missing.

The cheapest policy is sometimes the most expensive mistake.

Need help weighing up the extras?

This guide will help you decide.

How To Read The Fine Print Without Falling Asleep

Let’s be honest.

No one enjoys reading policy documents.

However, if you skip them, you could be missing critical exclusions that cost you later.

So, how do you navigate the fine print without zoning out?

Here’s how:

- First, head straight to the exclusions section — this is where insurers hide what they won’t cover

- Next, look for the phrase “Driving Other Cars” — if it’s not mentioned, you’re not covered

- Then, find out whether breakdown assistance and a courtesy car are standard or optional

- Finally, double-check whether you need to list every named driver

Sounds tedious?

Yes.

But it’s better than finding out after an accident that you’re on your own.

Besides, there’s a smarter way.

Today, most major insurers offer online tools and mobile apps to help you review your cover — in seconds.

So instead of scanning through paper documents, you can log in, tap twice, and get the facts.

That convenience can save you stress and money.

Want to know how fast you could be covered?

Here’s how online car insurance makes it simple.

Finding The Cheapest Car Insurance UK Without Risking Gaps

At first glance, the cheapest policy always looks like the best deal.

But dig deeper.

Does it actually cover what you need?

That’s the real question.

So, how do you find cheap car insurance that doesn’t leave you exposed?

Here’s a better way to do it:

- Start by comparing cover levels — not just price

- Then consider telematics if you’re a careful driver

- Don’t forget to add extras like windscreen protection or legal cover

- Double-check your voluntary and compulsory excess — low premiums often mean high payouts later

- Finally, research customer service ratings — because support matters when things go wrong

In short?

It’s not just about paying less.

It’s about making sure the cover you get is actually useful.

For many drivers, the smart move isn’t cutting cover — it’s finding hidden value in the policy itself.

Want a place to start?

Explore these very cheap car insurance options now.

Conclusion

Don’t Let the Word “Comprehensive” Fool You

Now that we’ve broken it down, let’s recap.

Comprehensive insurance is undeniably the most complete standard cover you can buy.

However, it still has limits.

Despite its name, it won’t cover every scenario — unless you read the small print and choose the right extras.

So what should you do now?

- Review your existing policy — check what’s missing

- Add only what you truly need — not what sounds fancy

- Use smart comparison tools — focus on cover first, cost second

- Stay alert to what isn’t included, especially vandalism, windscreen chips, and courtesy car use

Ultimately, the word “comprehensive” shouldn’t lull you into a false sense of security.

Because unless you’ve taken time to tailor your policy?

You might not be nearly as covered as you think.

And when that moment comes, it’ll be too late to fix it.

So act now — before your assumptions become an expensive lesson.

Still Wondering What’s Right For You?

These posts can help you build on what you’ve learned: