Introduction

Road Safety Law Changes…

Car Insurance in the UK could be on the brink of a fundamental shift.

New Government proposals aim to clamp down on drink-driving, unsafe vehicles, and high-risk motorists.

And crucially, these changes could directly affect how Cheap Car Insurance is priced, approved, and renewed.

For drivers already hunting for the cheapest car insurance, the timing matters.

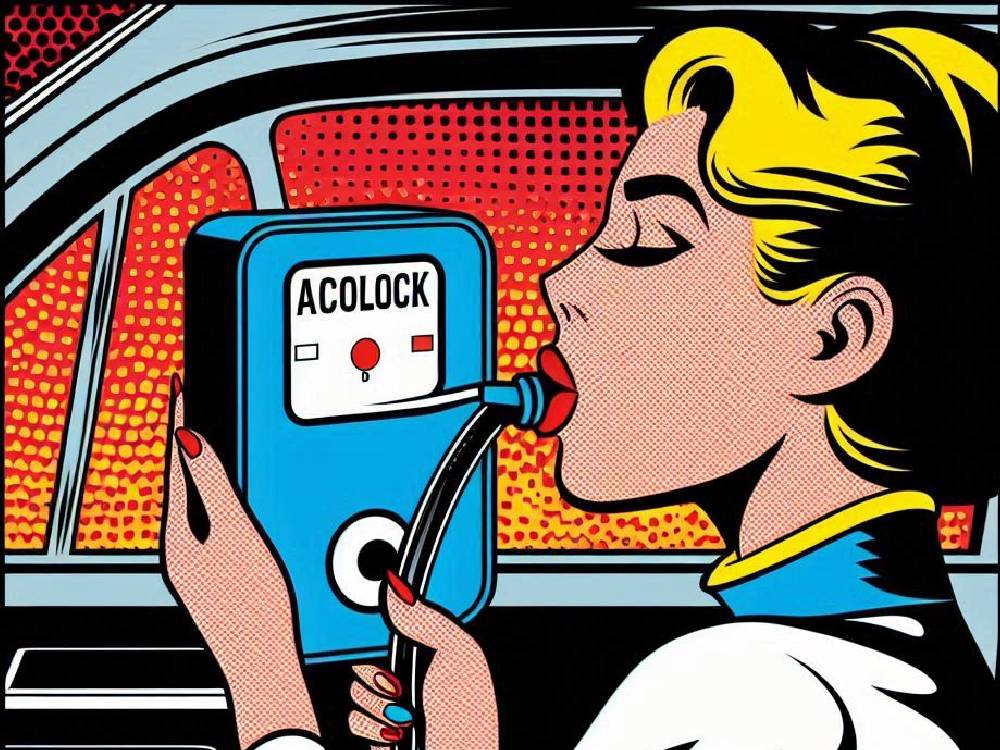

Road Safety Law Changes: Breathalysers Could Be Fitted To Car Ignitions

Convicted drink-drivers may soon face a new condition to get back on the road.

A breathalyser.

Built into their car.

These devices, often called alcolocks, stop the engine from starting unless the driver passes a breath test.

No pass.

No ignition.

This proposal sits at the heart of the Government’s biggest road safety shake-up in more than a decade.

And for Car Insurance providers, it changes the risk equation entirely.

Drivers who once posed a high risk could, theoretically, become safer overnight.

But insurers don’t move on theory alone.

They price on behaviour.

And convictions still matter.

Especially when you’re applying for Cheap Car Insurance through brokers like

https://www.cheapcarinsurance.co.uk/

Now here’s the catch.

Even if alcolocks reduce repeat offences, insurers will still factor in the original conviction.

Which means premiums may stay higher for longer.

At least initially.

This is why understanding your car insurance options matters more than ever:

https://www.cheapcarinsurance.co.uk/car-insurance-options/

Different insurers respond to risk changes differently.

Some reward compliance.

Others remain cautious.

Lower Drink-Drive Limits And Tougher Enforcement: Road Safety Law Changes

The proposed reforms don’t stop with alcolocks.

Ministers are also considering lowering the drink-drive limit in England and Wales.

Scotland already did this.

And insurers took notice.

Lower limits mean more drivers fall foul of the law.

Even after “just one drink”.

Which matters because insurers treat drink-drive convictions as high-severity markers.

Once flagged, your access to very cheap car insurance narrows fast:

https://www.cheapcarinsurance.co.uk/very-cheap-car-insurance/

But enforcement is tightening too.

Police may gain stronger powers to suspend licences for suspected drink or drug-driving.

Before a conviction.

That changes everything.

Because even a temporary suspension can disrupt cover.

Miss a disclosure.

Delay informing your insurer.

And suddenly, your policy becomes vulnerable.

This is where Cheap Insurance UK stops being about price.

And starts being about precision.

Let’s be clear.

Insurers don’t wait for headlines.

They price ahead of them.

Which means drivers who stay informed gain an edge.

Why Younger Drivers Are Under The Microscope With Road Safety Law Changes

There’s another reason these proposals are moving fast.

Data suggests younger generations are increasingly willing to ignore drink-drive laws.

That worries policymakers.

And insurers.

Because younger drivers already sit in the highest-risk bracket.

Add alcohol.

Add enforcement changes.

And premiums rise sharply.

This is why young motorists are often pushed toward telematics-based policies.

If you’re navigating this space, guidance like this becomes essential:

https://www.cheapcarinsurance.co.uk/young-drivers-tips/

Here’s the reality.

When rules tighten, insurers don’t guess.

They react.

Which means the drivers who understand the system first often secure the cheapest car insurance before prices recalibrate.

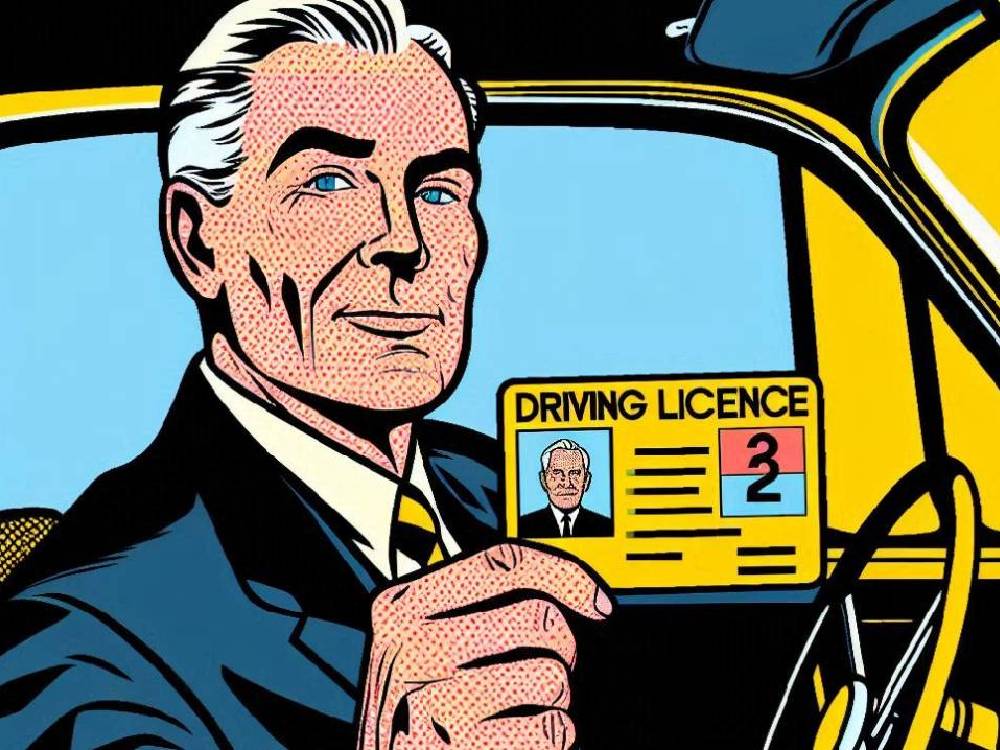

Licence Suspensions Could Happen Faster Than Ever

Here’s where things escalate.

Under the proposals, police could gain new powers to suspend licences for suspected drink or drug-driving.

Before a court ruling.

Before a conviction.

That matters.

Because insurers don’t wait for outcomes.

They respond to status.

If your licence is suspended, even temporarily, your Car Insurance position changes immediately.

Cover can be restricted.

Renewals can be declined.

Premiums can spike.

And if you fail to tell your insurer?

That’s where problems start.

If you’re unsure how insurers calculate risk during disruptions like this, it’s worth understanding the mechanics behind pricing:

https://www.cheapcarinsurance.co.uk/how-do-insurance-calculate-insurance/

Let’s pause here.

Because this catches many drivers out.

Even a short suspension must be disclosed.

Miss it.

And your policy could be invalid.

Here’s the subtle point many miss.

It’s not age that insurers price.

It’s uncertainty.

Mandatory testing reduces uncertainty.

Which can work in your favour.

If you stay compliant.

Learner Driver Reforms Could Reshape Family Policies

The shake-up doesn’t stop with existing drivers.

Learners are firmly in scope too.

Ministers are considering minimum learning periods of up to six months.

On paper, this improves safety.

In practice, it affects insurance structures.

Families often add learners to existing policies.

Or take out short-term cover.

Longer learning periods mean longer exposure.

And that influences cost.

If you’re supporting a new driver, understanding learner-specific insurance rules is essential:

https://www.cheapcarinsurance.co.uk/what-insurance-should-a-learner-driver/

But there’s another layer.

More supervised driving.

The miles logged.

More data.

Which insurers like.

Especially those pricing behaviour-based risk.

Crackdown On Ghost Number Plates And Vehicle Compliance

Finally, there’s enforcement.

Tougher laws on illegal or “ghost” number plates are part of the same reform package.

These plates make vehicles harder to identify.

Insurers hate that.

Because unidentified vehicles mean unresolved claims.

And unresolved claims push premiums up for everyone.

If your vehicle isn’t compliant, even accidentally, your policy may not protect you.

This ties directly into broader compliance guidance, such as how fines and penalties can affect your cover:

Understanding the risk of compliance

Let’s be blunt.

Insurers reward transparency.

They punish ambiguity.

These reforms aim to remove grey areas.

And Car Insurance pricing will follow.

Why The Government Is Pushing So Hard for Reform

At this stage, the motivation becomes clearer.

These proposals are not isolated.

They are part of a wider national strategy.

Specifically, the Government wants to cut deaths and serious injuries on UK roads by 65 per cent by 2035.

Meanwhile, for children under 16, the target rises to 70 per cent.

Because of that, policy is shifting from punishment to prevention.

Technology.

Monitoring.

Early intervention.

And, inevitably, Car Insurance reacts to all three.

Insurers don’t wait for targets to be met.

Instead, they price based on direction of travel.

Which means reform signals today often become premium changes tomorrow.

How These Targets Shape Insurance Pricing

Now, let’s connect the dots.

When governments push safety targets, insurers respond by adjusting risk models.

Gradually at first.

Then suddenly.

Drivers who align with safety measures benefit.

Drivers who resist them pay more.

This is why monitored behaviour, clean records, and full compliance increasingly unlock Cheap Car Insurance opportunities.

Especially when compared properly across the market:

Cheapest day to renew your car insurance

However, there’s another layer.

As safety technology increases, insurers gain more data.

More data means more precision.

And precision rewards low-risk drivers faster.

Which is exactly why switching at the right moment can matter more than loyalty:

https://www.cheapcarinsurance.co.uk/switch-car-insurance/

So, while these reforms may feel restrictive, they also create opportunity.

If you move early.

Why Alcolocks Could Eventually Lower Premiums

At first glance, breathalyser ignition locks sound punitive.

But step back.

In countries where alcolocks already exist, repeat drink-driving offences fall sharply.

Australia is a clear example.

Fewer repeat offences mean fewer serious claims.

And fewer claims influence long-term pricing.

So, although convicted drivers may initially face higher premiums, sustained compliance can slowly rebuild trust.

Over time.

Not instantly.

But gradually.

That distinction matters.

Because insurers value trends more than single events.

Which leads to a critical insight.

Car Insurance is no longer just about what you did.

It’s increasingly about what you do next.

What UK Drivers Should Do Now

At this point, action beats reaction.

The drivers who stay ahead usually pay less.

So, consider this carefully.

One, stay compliant with every new requirement.

Two, disclose everything promptly to your insurer.

Three, review your policy before renewal, not after.

Four, compare aggressively across the market.

Five, avoid assumptions about loyalty discounts.

Because assumptions cost money.

If cost control matters, resources that explain how to save systematically can help:

https://www.cheapcarinsurance.co.uk/5-ways-to-save-money/

Conclusion

Road Safety Law Changes

Ultimately, this is not just a road safety story.

It’s a Car Insurance story.

Breathalysers, lower drink-drive limits, licence suspensions, eye tests, and enforcement all feed into one outcome.

More data.

More control.

And segmentation.

For some drivers, that means higher premiums.

For others, especially compliant and informed motorists, it creates new routes to Cheap Insurance UK.

The difference lies in awareness.

And timing.

Drivers who understand how reforms affect insurers tend to secure the cheapest car insurance before the market recalibrates.

Those who don’t often pay the price later.

Quietly.

At renewal.