Introduction

Car theft insurance….

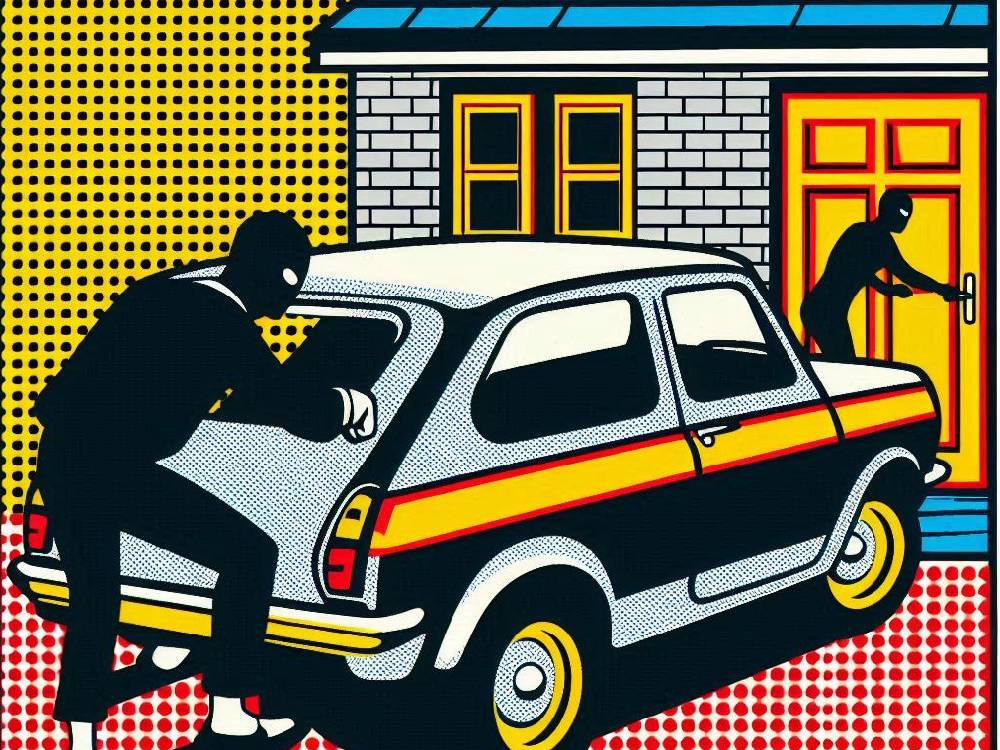

Someone stole your car.

Now what?

Due to a surge in vehicle-related crime, car theft is rising rapidly across the UK.

As a result, over 61,000 vehicles were stolen in 2024 alone, according to the DVLA.

That’s more than seven every hour.

But here’s the problem.

Most drivers only check their policy after their car disappears.

Don’t make that mistake.

What Is Car Theft Insurance?

Let’s clear this up quickly.

Car theft insurance pays for the value of your car if someone steals it or damages it during an attempted theft.

But not all policies include it.

If you’ve got comprehensive cover, you’re protected.

However, if you only pay for third-party or fire-only cover, you’re not.

Comprehensive insurance usually helps with:

- Replacing your stolen car

- Covering damage caused during a theft attempt

- Providing a courtesy car while you wait

Read the fine print.

Every policy comes with its own rules, limits, and excess.

Not sure what kind of policy you’ve got?

Check this breakdown of comprehensive vs third-party cover.

What To Do Immediately If Your Car Gets Stolen

Don’t freeze.

Act fast.

First, report the theft.

Call 999 if it’s happening right now.

Otherwise, contact the police on 101 as soon as you notice the car is missing.

You’ll need to provide:

- Vehicle make and model

- Colour and registration plate

- Where you last saw it

The police will give you a crime reference number.

Next, contact your insurer.

Start the claim process with your reference number in hand.

Many companies expect you to report the theft within 24 hours.

Time matters here.

Not sure your car’s even insured?

Use this guide to check your insurance status.

Does Your Insurance Actually Cover Theft?

This is where most people slip up.

Let’s break it down:

- Comprehensive cover:

Pays for theft and attempted theft

Also covers vandalism or break-ins

Usually includes repairs or replacement - Third-party only:

Offers no protection if someone steals your car

Only covers damage you cause to others - Third-party, fire and theft:

May include theft

Usually excludes belongings left in the car

If you’re unsure, check your documents today.

Don’t wait until something goes wrong.

Still comparing policies?

Here’s a smart breakdown of third party vs fully comp.

What Happens If Police Recover Your Vehicle?

Your car’s back.

Now what?

Once the police recover your car, they’ll send you a notice letter with further instructions.

That letter includes:

- The recovery depot’s location

- A phone number to book collection

- Steps to follow before you arrive

But hold on.

Call your insurer first.

If they’ve paid out already, they might now own the car.

In that case, they’ll decide whether to collect it — or let you do so.

If they’ve taken the V5C logbook, you’ll need a written release letter from them before you can collect the car.

Don’t just show up.

Book an appointment with the recovery centre.

Take ID and check that the Vehicle Identification Number (VIN) matches your car.

If you can’t unlock the vehicle, you’ll need a locksmith on site.

Want to know how commercial policies?

Read this guide on what commercial cover includes.

Will My Insurance Cost More After a Theft?

Unfortunately, yes — in most cases.

Once you make a theft claim, your insurer sees you as a higher risk.

That label can stick with you for years.

Expect a noticeable jump in premiums when it’s time to renew.

But don’t just accept it.

Instead, shop around.

Many providers weigh risk differently, and some might offer better deals even after a claim.

Want to slash your renewal quote?

Follow these five proven ways to save money on car insurance.

Can I Get Insurance If My Car Was Previously Stolen?

Yes, but there’s a catch.

You can still get insured — even if your car’s been stolen before.

But here’s the deal:

Insurers may mark your vehicle as higher risk.

This could mean:

- Fewer quotes

- Stricter terms

- Higher prices

Be honest about the car’s history.

Otherwise, you risk invalidating future claims by hiding past thefts.

Use a broker who compares dozens of providers to find the very cheapest car insurance.

You might pay a bit more — but you’ll still get covered.

Should I Consider Black Box Insurance?

Yes — if you’re looking to cut costs and stay protected from theft.

In fact, black box insurance monitors your driving using a discreet device fitted in your vehicle.

But that’s not all.

Many black box policies also include GPS tracking.

If your car gets stolen, this tech can help police find it faster — or recover it before serious damage happens.

In addition, driving safely can earn you steady discounts over time.

If you’re a careful driver, this could genuinely change the game.

Want to learn more?

Check out this full guide on telematics car insurance.

Conclusion

Even if you can’t stop a theft, you can still control what comes next.

Car thefts aren’t rare.

In fact, they’re alarmingly common.

But the difference between disaster and recovery lies in what you do next.

Remember:

- Call the police straight away

- Report the crime to your insurer quickly

- Understand what your policy covers

- And if you’re not covered? Change that.

Comprehensive policies offer the best protection — not just for your car, but for your peace of mind.

Still wondering what type of policy fits your situation?

Check out our expert breakdown of car insurance options.

Want to keep learning?

These guides dig even deeper: