Introduction

Car insurance and headphones.

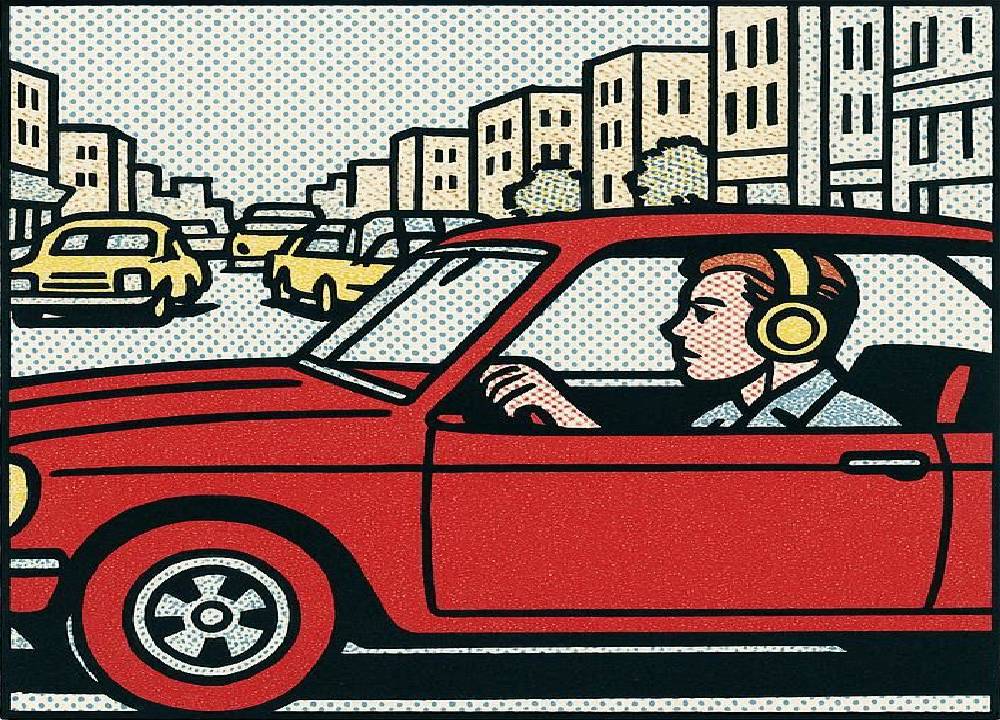

Driving while listening to music, podcasts, or phone calls through headphones might feel harmless, but it’s riskier than you think.

Ignoring the sounds around you can affect both your safety and your car insurance.

In this article, we’ll cover:

- Whether wearing headphones while driving is legal in the UK

- The safety risks involved

- Fines and penalties you could face

- Safer alternatives to headphones

- Tips to protect both your licence and your cheap car insurance

Are Headphones Legal While Driving In The UK?

You might assume headphones are safe.

After all, there’s no law explicitly banning them.

But here’s the tricky part…

The police can issue fines for driving without due care and attention.

Here’s what most drivers don’t realise…

Even if it’s not illegal per se, wearing headphones can still land you in trouble.

Think about it.

If an emergency vehicle’s siren goes unnoticed, or a cyclist swerves in front of you, can you react in time?

Experts warn that cutting out hearing can dramatically reduce your road awareness.

And if something serious happens?

You could be facing £5,000 in fines, nine points on your licence, or even a driving ban.

Using headphones isn’t just a minor distraction.

It’s a way of ignoring critical cues from the road around you.

This includes:

- Emergency sirens

- Horns from other drivers

- Shouts or warnings from pedestrians

Even worse, handling your mobile device while using headphones can multiply the danger.

The Highway Code is clear:

“It’s illegal to hold and use a phone, sat nav, tablet, or any device that can send or receive data, while driving or riding a motorcycle.”

This applies whether you’re stopped at lights, stuck in traffic, or supervising a learner driver.

Ignoring it could cost you both money and points on your licence.

For younger drivers, the consequences are even more severe. Learn more in our young drivers tips guide.

Car Insurance And Headphones: Safety Risks Of Wearing Headphones

It’s easy to see why people choose headphones in older cars.

Modern vehicles often come with built-in Bluetooth and hands-free options, making headphones unnecessary.

But older models?

Drivers might feel tempted to plug in headphones to catch up on music or podcasts while commuting.

That’s where the danger comes in.

Imagine this…

You’re listening to your favourite playlist.

A cyclist suddenly appears from behind a parked van.

Your headphones muffled the sound of their bell.

You have no warning.

That split second could make all the difference.

Worse still, using headphones usually means handling your mobile phone.

Distraction. Fines. Potentially higher cheap insurance UK premiums.

Fines And Penalties

The rules aren’t just guidelines.

You could face:

- £100 on-the-spot fines for careless driving

- Three points on your licence

- Court appearances for more serious incidents

- Up to £5,000 in financial penalties

- A potential driving ban

Here’s the kicker…

If your headphones contribute to a collision, insurers could view it as negligence.

That could affect your cheap car insurance rates, especially if it’s your first claim.

Even if the accident seems minor, insurance companies often flag risky behaviour.

So wearing headphones isn’t just about safety—it’s also about keeping your insurance premiums low.

Car Insurance And Headphones: The Alternatives

Fortunately, you don’t need headphones to enjoy music or take calls while driving.

In fact, most modern cars come with built-in speakers, Bluetooth connectivity, or hands-free phone systems.

Even if your vehicle is older, simple upgrades like speakerphone adapters or Bluetooth kits can make a huge difference.

Here’s a tip you shouldn’t ignore…

Switching to these alternatives keeps your hands free, which is safer for you and everyone else on the road.

Additionally, it allows you to hear everything happening around your vehicle, including horns, sirens, and even subtle warnings from pedestrians.

Not only is this a smarter choice for safety, but it can also protect your cheap car insurance from potential claims caused by distracted driving.

Furthermore, using headphones increases the risk of handling your mobile device, which could lead to penalties under the Highway Code.

Don’t risk it.

By keeping your focus on the road, you minimise accidents and avoid potential insurance hikes.

Tips For Staying Safe And Protecting Your Car Insurance

Of course, avoiding headphones is just the first step.

You also need to take practical actions to ensure both your safety and your insurance rates remain low.

Here’s what you can do:

- Avoid headphones while driving, even for short trips

- Use in-car Bluetooth or hands-free systems whenever possible

- Plan your routes ahead of time to reduce distractions

- Stay constantly aware of other vehicles, pedestrians, and cyclists

Remember this…

Your licence, your safety, and your car insurance all depend on your attentiveness.

Moreover, even small lapses in awareness can have major consequences, including accidents, fines, or increased premiums.

Finally, by following these steps consistently, you’re not only protecting yourself but also signalling responsible behaviour to insurers, which may help maintain the cheapest car insurance rates available.

Conclusion

In conclusion, wearing headphones while driving may seem harmless, but the risks are very real.

From fines and penalty points to potential increases in cheap car insurance premiums, the stakes are higher than many drivers realise.

Luckily, modern alternatives such as in-car Bluetooth, hands-free systems, or built-in speakers make headphones unnecessary.

Here’s the bottom line…

Keeping your ears open and your attention focused ensures you stay safe on the road.

Avoid legal trouble and maintain your cheap insurance UK.

Remember, staying alert isn’t just about obeying the law—it’s also about protecting your wallet and your family.

For comprehensive guidance and to find the cheapest car insurance in the UK, visit our website today.

If you found this article useful, you might also like: