Introduction

The debate over whether the UK should introduce a maximum driving age has divided motorists, politicians, and insurers alike.

While millions of older drivers remain safe behind the wheel, campaigners argue that age-related health issues could pose new risks.

So what’s really at stake here?

If you want a quick primer on cover types, see Comprehensive vs Third Party.

The UK’s Current Rules On Older Drivers: Maximum Driving Age

Let’s start with the facts.

The UK has no official maximum driving age.

That’s right — there is currently no legal cut-off that forces drivers to hand over their licences at a certain age.

Instead, motorists must renew their licence at 70.

From there, renewal happens every three years.

But here’s the catch.

It relies heavily on drivers self-reporting health changes.

So what does this mean for insurance?

It means that insurers have to calculate risk without strict age-based limits.

Naturally, this can push up premiums for elderly drivers.

If you want to explore your options, take a look at Car Insurance Options.

And if you’re wondering how new rules could affect you, here’s a guide on Navigating New Rules for Drivers Over 70.

Calls For A Maximum Driving Age

So, should we have a cut-off?

Experts argue yes.

Some suggest a maximum age limit in the 80s.

Why?

Because health can deteriorate quickly.

Reaction times slow.

Eyesight weakens.

And insurers know this all too well.

If road safety becomes harder to guarantee, insurance prices rise.

But here’s the interesting part.

Finding the cheapest car insurance doesn’t just depend on age.

It also depends on how insurers view risk collectively.

Which raises another question.

Would banning drivers beyond 80 really lower costs for everyone else?

It’s a debate far from settled.

Want to find out how insurers currently manage age-based premiums?

Check out Very Cheap Car Insurance.

You can also compare how older drivers fare with Navigating Cheap Car Insurance For Seniors – UK Drivers Over 70.

Labour’s Road Regulation Review On Maximum Driving Age

Now, let’s talk politics.

Labour has been examining road safety regulations.

They’re not pushing for a maximum driving age — at least not yet.

Instead, they’re considering compulsory eyesight checks for over-70s.

This sounds sensible, right?

But here’s where it gets complicated.

Campaigners argue that this doesn’t go far enough.

If fitness to drive is left too flexible, insurance companies still face higher uncertainty.

And uncertainty means higher prices.

For some motorists, especially older women who statistically drive fewer miles, the impact could be huge.

To see how this plays out in real terms, take a look at Cheap Car Insurance for Women.

Plus, keep in mind that your medical status could affect your policy — see What Medical Conditions Affect Car Insurance.

What The Public Thinks

Public opinion is split.

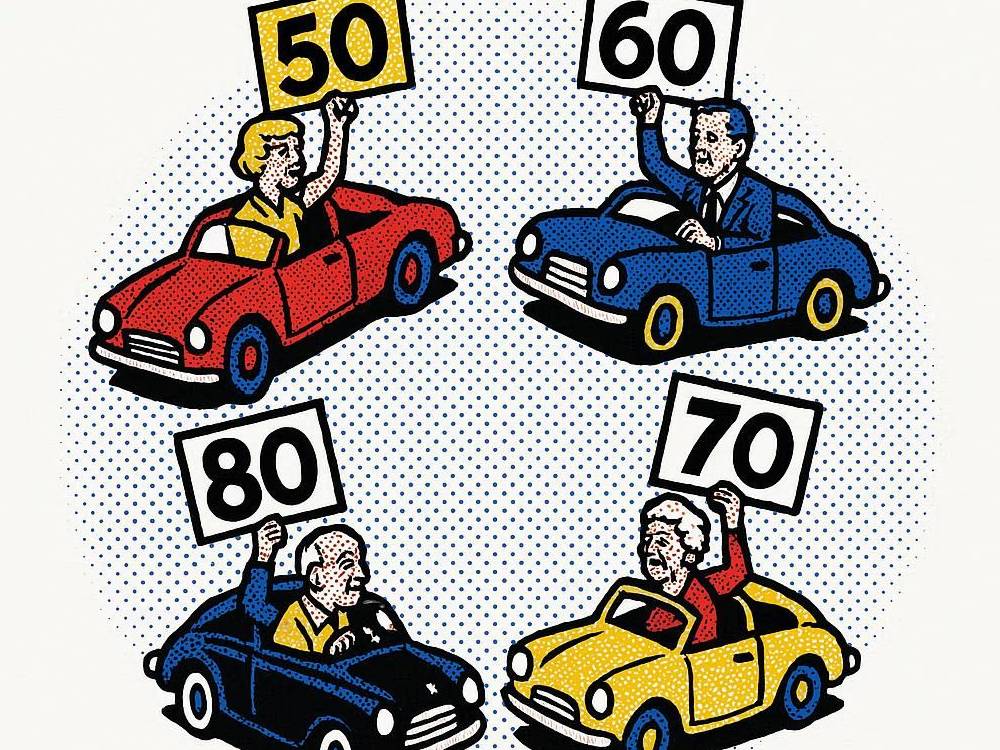

A poll of 2,000 drivers revealed that 36% want a maximum driving age.

That’s more than one in three.

But here’s where things get interesting.

11% said the cut-off should be 70.

8% said it should be 60.

And 5% believe the maximum age should be just 50.

That’s shockingly young, right?

Clearly, drivers are divided between safety and independence.

And this split mirrors the insurance market.

The more the public supports restrictions, the more likely insurers will prepare for change.

If you want to keep your policy affordable, don’t miss these 5 Ways to Save Money.

Realities Of Driving In Your 70s, 80s, And Beyond

But here’s the other side.

Millions of older drivers are still safe.

In 2020, around 5.6 million drivers over 70 were still on the road.

Many were confident, capable, and experienced.

And get this.

Some even continue driving into their 90s.

That’s right — your ability to drive doesn’t vanish with age.

Instead, it depends on health, awareness, and honesty.

This is where modern solutions like telematics come in.

By monitoring driving behaviour directly, insurers can separate safe older drivers from risky ones.

This means cheaper premiums for those who prove their skill.

Want to know how it works?

Here’s a guide on Telematics Car Insurance.

You should also explore how Your Credit Score plays a surprising role in your premiums.

How A Maximum Driving Age Would Impact Car Insurance

So what happens if a maximum age is introduced?

The impact on car insurance would be significant.

First, insurers would immediately adjust their pricing models.

However, this wouldn’t just affect older drivers.

Instead, the entire risk pool would shift.

Older drivers — already facing higher premiums — might be excluded entirely.

As a result, younger motorists could unexpectedly see costs rise.

Why?

Because insurers spread financial risk across all age groups.

Remove one group, and the balance breaks.

Therefore, the cheapest car insurance might become harder to secure.

On the other hand, safety improvements could push some premiums down.

It all depends on how regulators and insurers respond.

If you want to understand the maths behind premiums, see How Do Insurance Companies Calculate Car Insurance?.

In addition, you may find Temporary Car Insurance a useful option for short-term flexibility.

Balancing Safety, Freedom, And Affordability

So how do we strike the right balance?

On one hand, road safety must come first.

On the other hand, independence matters deeply for elderly people, especially those in rural communities.

Without a licence, they risk losing access to healthcare, family, and even daily essentials.

Therefore, the debate cannot be solved with one blunt rule.

Instead, experts suggest regular health checks and telematics solutions.

These tools allow safe older drivers to prove their competence.

If your circumstances change, remember that Switching Car Insurance could deliver immediate savings.

The Future Of Driving And Insurance In The UK

Looking ahead, the debate is only going to intensify.

Electric vehicles are becoming more common.

At the same time, self-driving technology is developing quickly.

As a result, insurers will need to adapt once again.

For elderly drivers, this shift could actually provide new opportunities.

In fact, advanced assistance systems may help compensate for slower reflexes.

Meanwhile, the rise of autonomous driving could reduce the need for licence restrictions altogether.

However, until these innovations become mainstream, the conversation about a maximum driving age will continue.

Therefore, the best move today is to stay informed.

Compare policies regularly.

And always search for the cheapest car insurance UK that fits your needs.

If you’re considering the switch to electric, see Car Insurance for Electric Vehicles.

Conclusion

So where does this leave us?

Currently, the UK has no maximum driving age.

However, public support and political debate suggest that changes could arrive sooner than many expect.

If a cut-off age is introduced, insurance costs will undoubtedly shift.

Older motorists could be excluded from cover.

Meanwhile, younger drivers might face higher premiums.

Therefore, the smartest strategy is to plan ahead.

By comparing policies, switching when necessary, and embracing new technology, you can still secure the cheapest car insurance.

For peace of mind, start with Cheap Car Insurance UK.

Similar Blog Links

Want to explore more insights?

Here are some related guides worth reading: