Introduction

Uninsured Driver Promise…

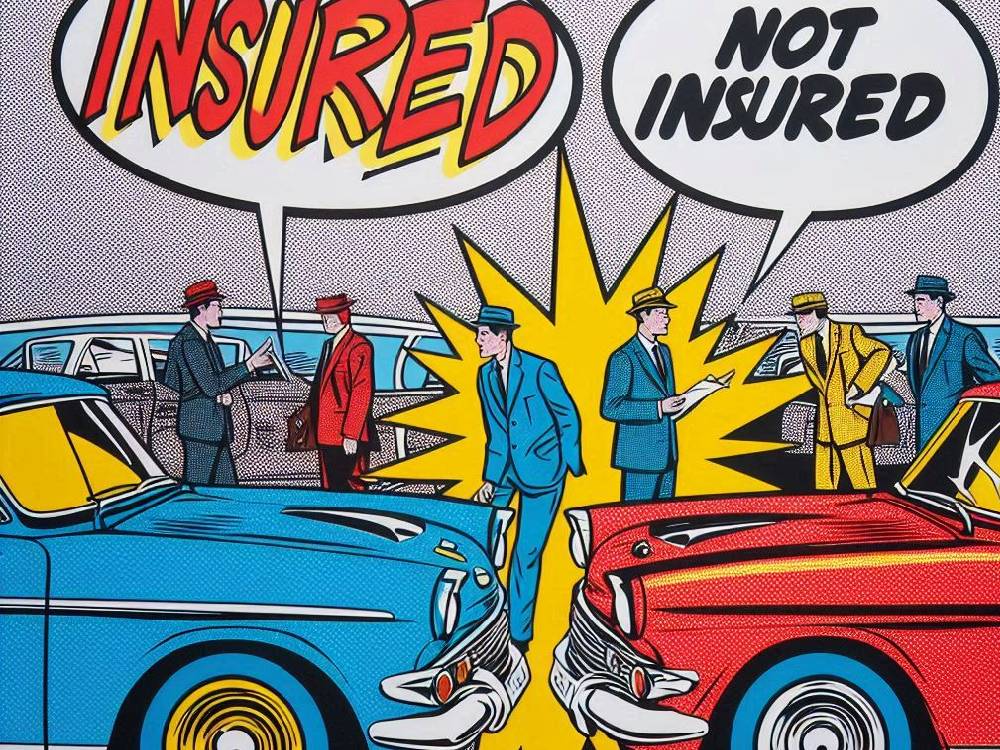

Car Insurance sounds simple.

Until the other driver doesn’t have any.

That’s where the Uninsured Driver Promise quietly becomes one of the most important parts of your policy.

Especially if you’re searching for Cheap Car Insurance or Cheap Insurance UK cover that still protects you properly.

Uninsured Driver Promise

Here’s the thing.

Not all Car Insurance policies treat uninsured drivers the same way.

And that difference can cost you hundreds.

Sometimes more.

This is where the Uninsured Driver Promise steps in.

But only if your policy genuinely includes it.

Many very cheap car insurance deals mention it briefly.

Some bury it.

Others quietly limit it.

So what is it, really?

In simple terms, the Uninsured Driver Promise is designed to protect you if you’re hit by someone who has no valid insurance.

If the promise applies, your insurer should refund your excess.

And your no-claims discount should stay intact.

That sounds reassuring.

But only on paper.

Because the promise almost always comes with conditions.

And this is where drivers get caught out.

What The Uninsured Driver Promise Actually Covers

In most UK policies, the promise applies when three things happen.

First, the accident was not your fault.

Second, the other driver was uninsured.

Third, you can clearly prove both points.

Miss one of those.

And the promise often collapses.

This matters even more if you’re shopping for Cheap Car Insurance online, where policies can look identical at first glance.

They aren’t.

Some insurers require the other driver to be fully identified.

Others insist on police involvement.

Some demand independent witnesses.

And if you can’t provide that?

Your excess may not be refunded.

Your no-claims discount may still take a hit.

That’s not what most drivers expect.

Why Cheap Policies Can Still Work Brilliantly

Now, this is important.

Cheap doesn’t automatically mean bad.

Many Cheap Insurance UK policies include a solid Uninsured Driver Promise.

You just need to know where to look.

That’s exactly why using a broker matters.

At CheapCarInsurance.co.uk, policies are compared on the details that actually cost you money later.

Not just the headline price.

That includes:

- Excess protection

- No-claims treatment

- Uninsured driver conditions

Because when something goes wrong, the small print becomes very loud.

The Assumption That Causes The Most Problems

Most drivers believe this:

“If I’m not at fault, I won’t lose out.”

That assumption feels logical.

But it’s often wrong.

Without the Uninsured Driver Promise applying in full, insurers can still:

- Charge your excess upfront

- Temporarily reduce your no-claims discount

- Delay refunds until liability is proven

And that process can take months.

Even with comprehensive vs third party policies, the outcome isn’t always equal.

This surprises people who thought they were fully protected.

Especially those who chose the cheapest car insurance option without checking how claims are handled.

Uninsured Driver Promise: Why Evidence Suddenly Matters More Than Price

At this point, price stops being the issue.

Proof becomes everything.

Insurers don’t work on sympathy.

They work on documentation.

If the other driver disappears.

When details are missing.

If there’s no independent confirmation.

Your claim becomes harder to support.

And this is why understanding the Uninsured Driver Promise before you ever need it matters so much.

Let’s make this practical.

Because knowing what to do after a crash is what separates drivers who lose money from those who don’t.

How To Gather Evidence After A Crash

This is the part nobody plans for.

But it decides everything.

Especially when the other driver has no insurance.

What to do immediately

First, stay calm.

Then get organised.

Because insurers move fast.

And gaps get punished.

Here’s what matters straight away:

- Photos of both vehicles

- The exact location

- Time and date

- Any visible damage

If possible, take wide shots.

Then close-ups.

Not later.

Not when you get home.

Now.

Stop here.

This is critical.

If the driver refuses details, don’t argue.

Just document it.

Then contact the police.

A police reference number often becomes the difference between a smooth claim and months of stress.

This is also when checking whether the vehicle is insured matters.

You can do that quickly using guidance like

how to check if a car is insured

Once you’ve checked, save the result.

Screenshots count.

Uninsured Driver Promise: Evidence that strengthens your claim

Insurers don’t want stories.

They want proof.

The strongest evidence usually includes:

- Independent witnesses

- Dashcam footage

- Police incident numbers

- Confirmation the driver was uninsured

Even one of these helps.

Two makes your claim far stronger.

This is where drivers with Cheap Car Insurance often assume they’ll be treated unfairly.

That’s not always true.

But the evidence still has to be there.

Here’s the uncomfortable truth.

Without evidence, even the best Uninsured Driver Promise struggles to protect you.

That’s why understanding policy wording matters before an accident.

Not after.

If you’ve ever compared comprehensive vs third-party cover, you’ll know that protection isn’t always where you expect it to be.

You can explore the differences properly here:

https://www.cheapcarinsurance.co.uk/comprehensive-vs-third-party/

Use that knowledge early.

It pays off later.

The mistakes that cost drivers money

Most mistakes aren’t dramatic.

They’re small.

And very human.

Like:

- Forgetting to photograph the other car

- Trusting the other driver’s word

- Not involving the police

- Assuming insurers will “sort it out”

They won’t.

Not without paperwork.

That’s why brokers constantly stress preparation.

It’s also why switching policies without checking claim conditions can backfire.

If you’re considering a move, this guide helps avoid that trap:

https://www.cheapcarinsurance.co.uk/switch-car-insurance/

What I Wish I’d Known About The Uninsured Driver Promise

This section always hits hardest.

Because hindsight is expensive.

The fine print nobody reads

Most drivers skim policies.

That’s normal.

But buried clauses decide:

- Whether your excess is refunded

- How long refunds take

- Whether your no-claims bonus survives

And yes, Cheap Insurance UK policies can still be excellent here.

You just need clarity.

That’s why guides like

https://www.cheapcarinsurance.co.uk/car-insurance-options/

exist in the first place.

Here’s something else people miss.

Your credit score, claim history, and even previous convictions can influence how smoothly claims are handled.

Not just how much you pay.

If you’ve never looked into that, this helps:

https://www.cheapcarinsurance.co.uk/your-credit-score/

Small details.

Big consequences.

Why preparation beats panic

Drivers who understand their policy before a crash react better after one.

They:

- Gather evidence properly

- Ask the right questions

- Avoid emotional decisions

That’s why very cheap car insurance isn’t the enemy.

Ignorance is.

Conclusion

The Uninsured Driver Promise isn’t marketing fluff.

It’s protection.

But only if you understand it.

Only if you meet the conditions.

And only if you act correctly when it matters.

Choosing Cheap Car Insurance doesn’t mean cutting corners.

It means choosing smartly.

That’s the difference.

“Insurance only feels expensive until you actually need it.”

Remember that.

Because the right policy doesn’t just save you money.

It saves you stress.

And sometimes, months of it.

Further Reading and Helpful Guides

If this topic made you rethink your cover, these guides are worth your time.

They explore related areas drivers often overlook, from very cheap car insurance strategies to specialist policies and cost-saving insights.

You may find value in reading about:

https://www.cheapcarinsurance.co.uk/very-cheap-car-insurance/

https://www.cheapcarinsurance.co.uk/5-ways-to-save-money/

https://www.cheapcarinsurance.co.uk/young-drivers-tips/

Sometimes, one extra read prevents a very expensive mistake.